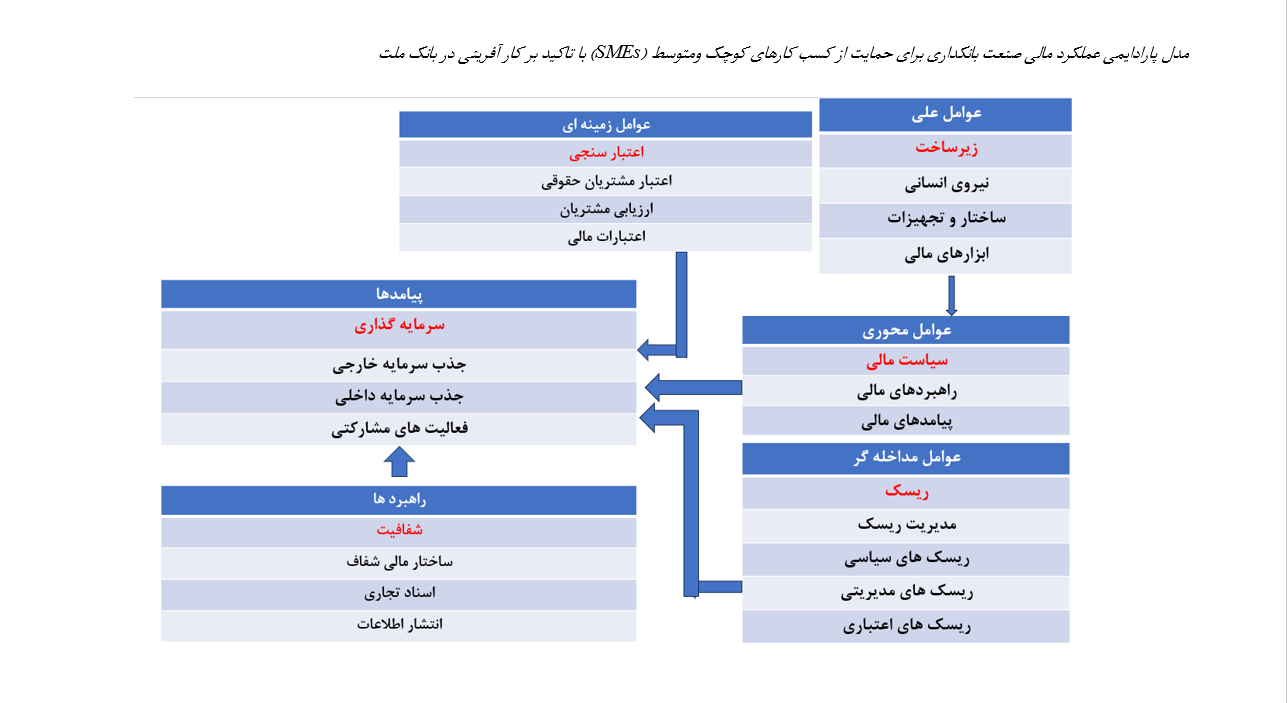

Identification of Criteria Affecting the Financial Performance of the Banking Industry to Support Small and Medium Enterprises (SMEs) with Emphasis on Entrepreneurship

Abstract

The aim of the present study is to identify the criteria affecting the financial performance of the banking industry in supporting small and medium enterprises (SMEs) with an emphasis on entrepreneurship. This research is applied in nature and qualitative in method. The statistical population comprised experts familiar with the research topic, including university professors in the fields of banking and entrepreneurship, as well as senior managers from Bank Mellat. The sampling was conducted theoretically, resulting in interviews with 12 experts until saturation was reached. The research approach was grounded theory, which involved interviews with experts and three types of coding: open, axial, and selective. Data collection was carried out through interviews with experts. To rank and categorize the factors, determine the types of variables, and examine the relationships between the model variables, as well as to assess the intensity of these relationships and identify the influence and dependency of the criteria, a combined ISM-DEMATEL method was employed. The results indicated that the main categories of the model include validation, infrastructure, financial policy, investment, risk, and transparency. Furthermore, based on the research findings, the first level includes risk management; the second level includes investment and financial transparency; the third level includes infrastructure; the fourth level includes validation; and the fifth level includes financial policies. The findings reveal that financial transparency, investment, and validation are connective factors, while infrastructure and risk are dependent factors, and financial policies are influential factors.

Downloads