Presenting a Customer-Centric Banking Services Model in Refah Bank Using a Structural Equation Modeling Approach

Keywords:

Customer orientation, banking services, Refah Bank, structural equation modeling.Abstract

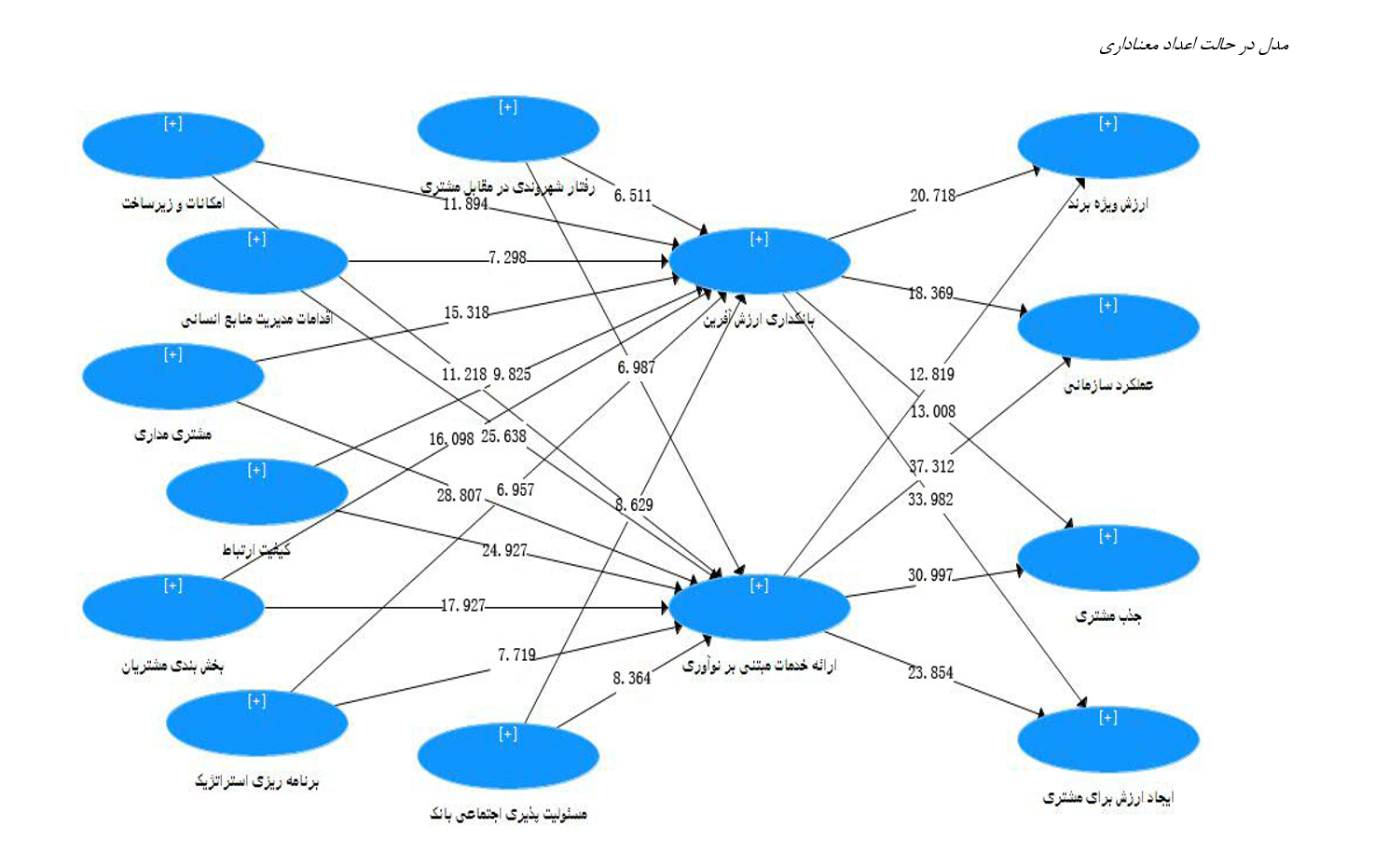

Given the high importance of customer-centricity, especially in the banking industry, the main objective of this study is to design a customer-centric banking services model at Refah Bank. Various studies have addressed different aspects of customer-centricity within the banking industry; however, the design of a customer-centric banking services model has not been explored. Therefore, this research aims to present a model of influential factors and outcomes in designing a customer-centric banking services model at Refah Bank using a structural equation modeling approach. This study is applied in terms of its objective and descriptive in terms of its nature and methodology. Additionally, from the perspective of data collection, it is a survey research. The statistical population consists of senior managers of each branch (branch manager, deputy manager, and head of accounting) and top customers of each branch. Six questionnaires were distributed at each branch, with responses obtained from three managers and three top customers per branch. The total number of Refah Bank branches in Tehran is 134. Given that six questionnaires were distributed per branch, the total population size is 804 individuals. According to Morgan's table, the sample size for this section is 260 individuals, with the researcher distributing questionnaires 10% above this number among the targeted sample. Notably, the sampling method used in this study is non-probability convenience sampling. The data collection tool used in this study was a questionnaire, with content validity and construct validity applied to assess validity. Content validity was evaluated based on feedback from several business management and marketing professors. To assess reliability, Cronbach's alpha coefficient and composite reliability were utilized, both of which were confirmed. Structural equation modeling with a partial least squares approach was used to test the research hypotheses. Based on the results, all research hypotheses were supported.

Downloads