Presenting a Customer-Centric Banking Services Model in Refah Bank Using a Structural Equation Modeling Approach

Keywords:

Customer-Centricity, Banking Services, Refah Bank, Structural Equation ModelingAbstract

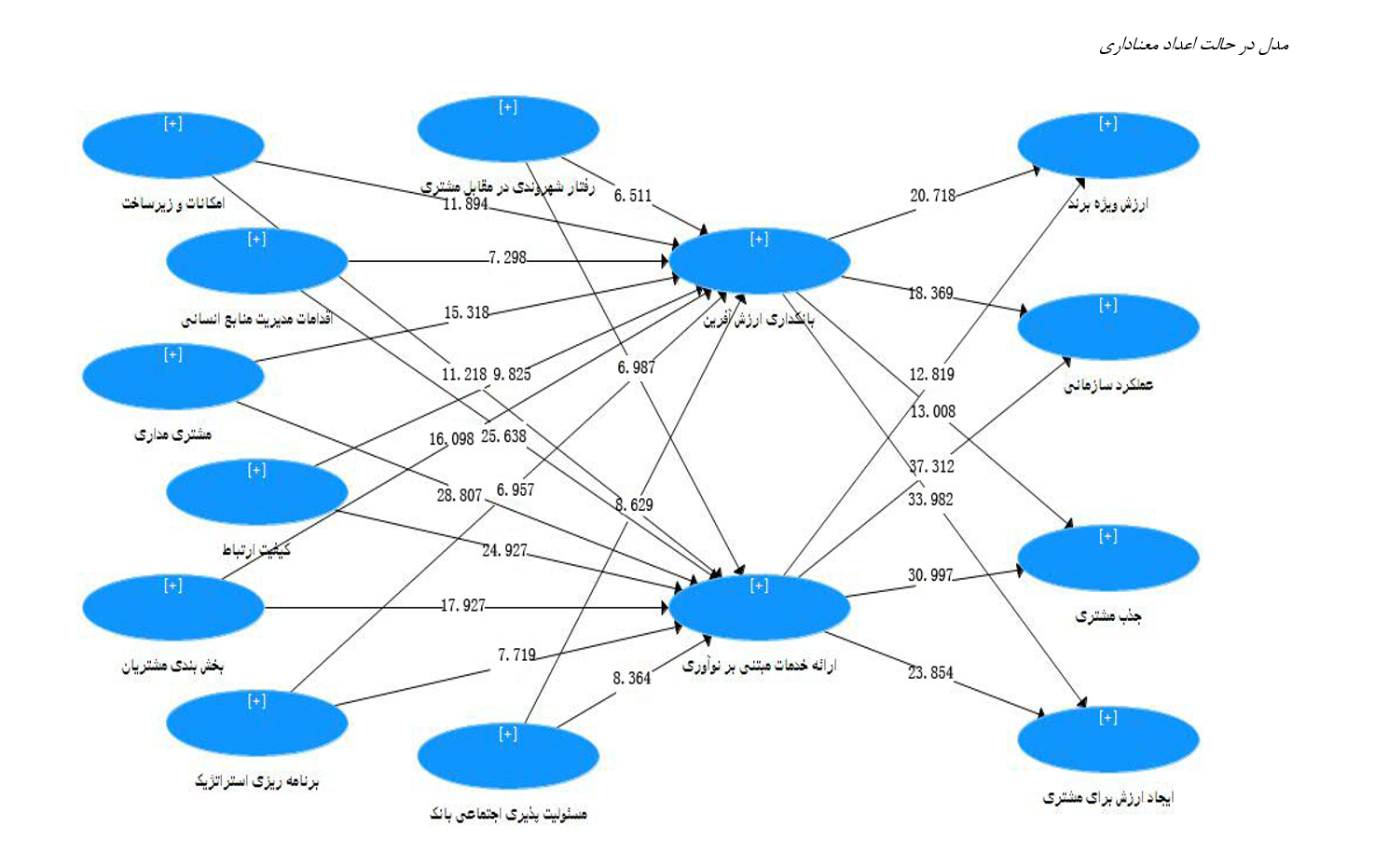

Given the high importance of customer-centricity, especially in the banking industry, the main objective of this study is to design a customer-centric banking services model at Refah Bank. Various studies have addressed different aspects of customer-centricity within the banking industry; however, the design of a customer-centric banking services model has not been explored. Therefore, this research aims to present a model of influential factors and outcomes in designing a customer-centric banking services model at Refah Bank using a structural equation modeling approach. This study is applied in terms of its objective and descriptive in terms of its nature and methodology. Additionally, from the perspective of data collection, it is a survey research. The statistical population consists of senior managers of each branch (branch manager, deputy manager, and head of accounting) and top customers of each branch. Six questionnaires were distributed at each branch, with responses obtained from three managers and three top customers per branch. The total number of Refah Bank branches in Tehran is 134. Given that six questionnaires were distributed per branch, the total population size is 804 individuals. According to Morgan's table, the sample size for this section is 260 individuals, with the researcher distributing questionnaires 10% above this number among the targeted sample. Notably, the sampling method used in this study is non-probability convenience sampling. The data collection tool used in this study was a questionnaire, with content validity and construct validity applied to assess validity. Content validity was evaluated based on feedback from several business management and marketing professors. To assess reliability, Cronbach's alpha coefficient and composite reliability were utilized, both of which were confirmed. Structural equation modeling with a partial least squares approach was used to test the research hypotheses. Based on the results, all research hypotheses were supported.

Downloads

References

Aghazadeh Hashem, M., & Mina, M. (2010). A local scale of market orientation for Iranian commercial banks. Business Management Perspectives, 35(2), 119-143. https://jbmp.sbu.ac.ir/article/view/article_94262.html

Asanloo, B., Ghobeh, M., & Fazli Nejad, P. (2017). The effect of brand orientation on internal brand equity. Business Management Perspectives, 14(32), 105-125. https://jbmp.sbu.ac.ir/article_96750.html

Azadeh, S., Ahmadian, S., & Mohaghegh Zadeh, F. (2019). The impact of customer satisfaction, trust, certainty, and positive word-of-mouth advertising on purchase intention with emphasis on social networks. Scientific Journal of Shabak, 5(47), 9-16. https://smrj.ssrc.ac.ir/article_908.html

Bahri Nejad, R., Khanlari, A., Hasankhlu, T., & Hosseini, S. M. (2018). Identifying the most important marketing processes in Iran's banking industry to develop a banking marketing maturity model. Journal of Business Management, 10(4), 795-814. https://jibm.ut.ac.ir/article_68466.html

Bozorg Asl, M., Samadi, M. T., & Barzideh, F. (2017). The relationship between liquidity risk and credit risk and its impact on financial instability in Iran's banking industry. Banking Research Journal, 10(33), 509-531. https://jik.srbiau.ac.ir/article_12137.html

Ghorbani, I. (2020). Evaluating the role of learning orientation, trust, and employee commitment on the effectiveness of logistics services. New Research Approaches in Management and Accounting, 41(Fall), 148-165. https://majournal.ir/index.php/ma/article/view/511

Hemmati, H., & Abbasi Far, A. (2015). The impact of stock market fluctuations on the performance of listed banks in the Tehran Stock Exchange. Economic and Business Journal, 6(10), 13-26. https://sanad.iau.ir/fa/Journal/jebr/DownloadFile/1046177

Heydari, H., Sadeghpour, S., & Dehghan, M. (2017). The relationship between inflation uncertainty and the amount of interest-free loans granted by banks. Research in Monetary and Financial Economics, 24(14), 135-154. https://danesh24.um.ac.ir/article_31696.html

Hosseinzadeh, M. R., & Khodadadi, A. (2018). Developing credit risk strategies based on the SWOT model in Bank Melli Iran. Scientific-Research Journal of Modern Marketing Research, 8(2), 55-68. https://nmrj.ui.ac.ir/article_23015.html

Jafari Samet, A. (2018). Mergers: An effective solution to prevent bank bankruptcies. Banking Research Journal, 11(37), 437-466. https://www.sid.ir/fa/journal/ViewPaper.aspx?ID=536796

Khoran, A., Karimzadeh, M., & Hadadian, A. (2014). Identifying and prioritizing factors influencing the selection of banks and financial institutions by customers. Rasht, June 21.

Kimasi, M., Rezaei, S., & Ghafari Nejad, A. H. (2016). The impact of banking sanctions on their profitability. Banking Research Journal, 9(24), 1-14. https://www.sid.ir/paper/263701/fa

Koole, B. (2020). Trusting to learn and learning to trust. A framework for analyzing the interactions of trust and learning in arrangements dedicated to instigating social change. 1-9. https://doi.org/10.1016/j.techfore.2020.120260

Mir Asgari, S. R., & Hosseini Nasaz, H. (2017). Analyzing the impact of macroeconomic variables on credit risk in banks. Research in Monetary and Financial Economics, 24(13), 175-199. https://danesh24.um.ac.ir/article_31478.html

Mohammadi Zarrandi, M. I., Alborzi, M., Hosseinzadeh Lotfi, F., & Shahriari, M. (2013). Providing a model based on value creation for evaluating financial performance in banks and financial institutions. Scientific-Research Journal of Accounting and Auditing Management, 2(7), 115-122. https://journals.srbiau.ac.ir/article_7504.html

Muhammad, A. (2024). Decentralized Finance (DeFi) and Traditional Banking: A Convergence or Collision. Economics Politics and Regional Development, 5(1), p1. https://doi.org/10.22158/eprd.v5n1p1

Nekoee Zadeh, M., & Amini, A. (2019). Analyzing Samsung's opportunistic technology in the mobile phone market with an emphasis on customer loyalty and trust. Journal of Technology Development Management, 7(3), 125-148. https://jtdm.irost.ir/article_896.html

Nourbakhsh, S. H., Shafiei Roudpeshni, M., & Mousavi, S. M. (2015). The effects of organizational culture on market orientation development in the banking system of the Islamic Republic of Iran: A case study of Bank Mehr Eqtesad in Greater Tehran. Strategic and Macro Policy Journal, 3(9), 67-95. https://www.jmsp.ir/article_9662.html

Pagliara, F., Aria, M., Russo, L., Della Corte, V., & Nunko, R. (2020). Validating a theoretical model of citizens' trust in tourism development. 1-35. https://doi.org/10.1016/j.seps.2020.100922

Pambudi, A., Widayanti, R., & Edastama, P. (2021). Trust and Acceptance of E-Banking Technology Effect of Mediation on Customer Relationship Management Performance. ADI Journal on Recent Innovation, 3(1), 87-96. https://doi.org/10.34306/ajri.v3i1.538

Prentice, C., Wang, X., & Loureiro, S. M. C. (2019). The influence of brand experience and service quality on customer engagement. 12, 50-59. https://doi.org/10.1016/j.jretconser.2019.04.020

Qasemi Doghagh, N. (2017). The impact of capabilities and resources of knowledge management on the organizational effectiveness of private and public banks in Gilan Province Rasha Islamic Azad University, Faculty of Management and Accounting]. https://elmnet.ir/article/1785976-23022/%D8%A8%D8%B1%D8%B1%D8%B3%DB%8C-%D8%AA%D8%A7%D8%AB%DB%8C%D8%B1-%D8%A7%D8%A8%D8%B9%D8%A7%D8%AF-%D9%85%D8%AF%DB%8C%D8%B1%DB%8C%D8%AA-%D9%85%D9%86%D8%A7%D8%A8%D8%B9-%D8%A7%D9%86%D8%B3%D8%A7%D9%86%DB%8C-%D8%A7%D9%84%DA%A9%D8%AA%D8%B1%D9%88%D9%86%DB%8C%DA%A9-%D8%A8%D8%B1-%D8%A7%DB%8C%D8%AC%D8%A7%D8%AF-%DA%86%D8%A7%D8%A8%DA%A9%DB%8C-%D8%B3%D8%A7%D8%B2%D9%85%D8%A7%D9%86%DB%8C-(%D9%85%D9%88%D8%B1%D8%AF-%D9%85%D8%B7%D8%A7%D9%84%D8%B9%D9%87_-%D8%A8%D8%A7%D9%86%DA%A9%D9%87%D8%A7%DB%8C-%D8%B4%D9%87%D8%B1-%D8%A8%D9%88%D8%B4%D9%87%D8%B1)

Rahmat Nejad, A., & Samadi, M. (2015). Studying the relationship between effective customer relationship management and organizational effectiveness from the perspective of Bank Mellat employees. Sociological studies, 7(28), 41-56. https://srb.sanad.iau.ir/en/Article/957686?FullText=FullText

Razazadeh, M., & Haj Ali Akbari, N. (2015). Examining the impact of brand credibility dimensions on the growth of small and medium-sized enterprises (Case study: Small and medium enterprises in Gilan Province) Zanjan Islamic Azad University, Faculty of Management]. https://civilica.com/doc/425819/

Saeib Nia, S., Arjang, S., & Javidi, A. (2019). Examining the impact of customer satisfaction and trust on the warranty of Saipa's body in dealership 2110 of Saipa Automotive Group in Ardabil Province. New Research Approaches in Management and Accounting, 3(11), 85-97. https://majournal.ir/index.php/ma/article/view/150

Saral, R., Salehzadeh, R., & Mirmehdi, S. M. (2024). Investigating the influence of service quality on loyalty in banking industry: the role of customer engagement. International Journal of Services, Economics and Management, 15(1), 1-19. https://doi.org/10.1504/IJSEM.2024.136057

Shahcheraghi, M., & Taheri, M. (2015). The impact of banking capital structure on the role of banks in liquidity creation in Iran's economy. Banking Research Journal, 8(23), 59-81. https://www.sid.ir/paper/263732/fa

Shahcheraghi, M., & Taheri, M. (2019). The impact of liquidity requirements on the Central Bank's policies in the interbank market in Iran. Banking Research Journal, 12(39), 23-48. https://www.noormags.ir/view/fa/articlepage/1524606/%D8%AA%D8%A7%D8%AB%DB%8C%D8%B1-%D8%A7%D9%84%D8%B2%D8%A7%D9%85%D8%A7%D8%AA-%D9%86%D9%82%D8%AF%DB%8C%D9%86%DA%AF%DB%8C-%D8%AF%D8%B1-%D8%B3%DB%8C%D8%A7%D8%B3%D8%AA-%DA%AF%D8%B0%D8%A7%D8%B1%DB%8C-%D8%A8%D8%A7%D9%86%DA%A9-%D9%85%D8%B1%DA%A9%D8%B2%DB%8C-%D8%AF%D8%B1-%D8%A8%D8%A7%D8%B2%D8%A7%D8%B1-%D8%A8%DB%8C%D9%86-%D8%A8%D8%A7%D9%86%DA%A9%DB%8C-%D8%A7%DB%8C%D8%B1%D8%A7%D9%86

Taheri, M., & Abdollahi, Z. (2016). Investigating the dynamics of financial leverage and optimal capital structure in the banking system of Iran. Journal of Monetary and Banking Development, 3(7), 29-50. https://civilica.com/doc/793750/

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 Journal of Technology in Entrepreneurship and Strategic Management (JTESM)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.