Developing the Business Model of Banks within the Framework of Smart Governance: From Policy-Making to Implementation with Emphasis on Digital Technologies and New Media

Keywords:

Information and communication technologies, digital economy, Digital transformation, digital banking, and smart governanceAbstract

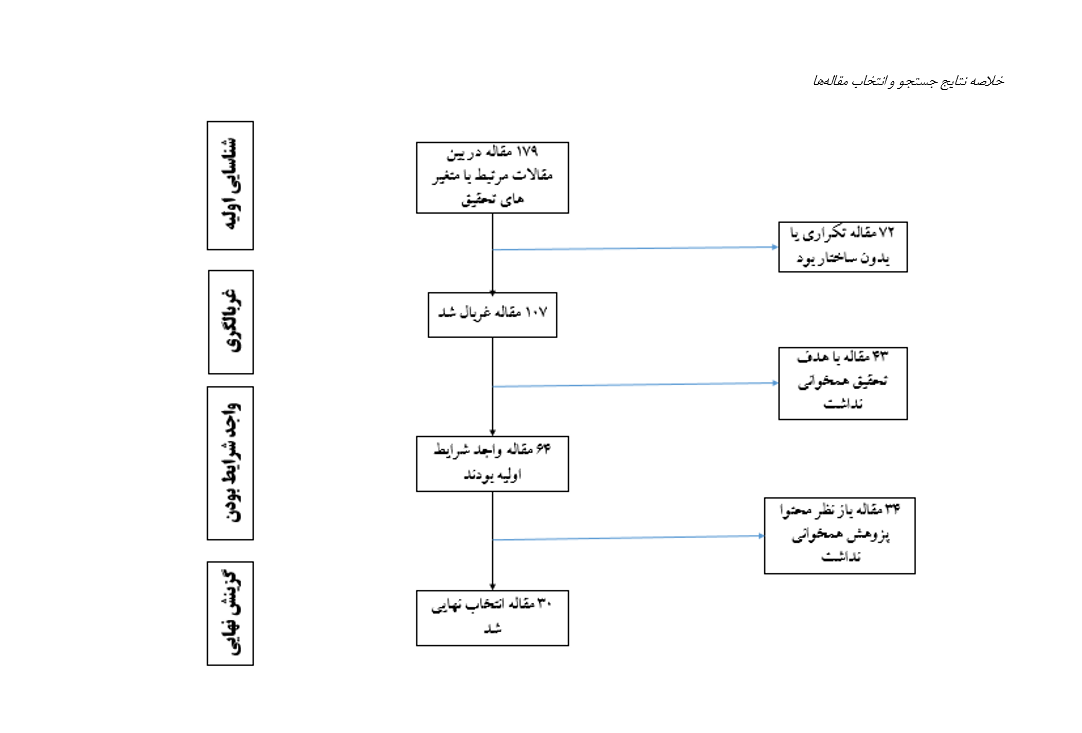

Today, digital disruption has also impacted the banking industry, compelling banks to plan strategically for success in an increasingly digital world that aligns with their organizational structure, customer base, and workforce. Accordingly, this study aimed to develop a business model for banks within the framework of smart governance, emphasizing digital technologies and new media. The study employed the meta-synthesis method to analyze findings from 30 domestic and international studies. The results revealed 53 components categorized under six key factors: digital transformation in banking, emerging technologies and digital infrastructure, digital customer engagement, digital policy-making and governance, interaction with fintechs and the innovation ecosystem, and implementation challenges and requirements. The proposed model underscores the integration of macro-level policy-making, technological infrastructure, and a focus on customer needs. It offers a practical pathway to enhance the efficiency and competitiveness of banks in the digital era. The findings not only provide a better understanding of policy-making requirements for transitioning to digital banking but also help identify influential components in the implementation phase.

Downloads

References

Accenture. (2023a). Digital transformation in banking: The path to value.

Accenture. (2023b). The future of banking: Transforming through technology.

Accenture. (2023c). Total Enterprise Reinvention. https://www.accenture.com/gb-en/insights/consulting/total-enterprise-reinvention-hub

Akbari, N., & Hosseini, F. (2022). AI applications in digital banking: From theory to practice. Artificial Intelligence and Data Mining Quarterly, 7(2), 73-90.

Asadollah, M., Sanavifard, R., & Hamidizadeh, A. (2019). E-banking business model based on fintech emergence. Technology Development Management Quarterly, 7(2), 43. https://jtdm.irost.ir/article_854.html

Ayandeh, B. (2023). Annual media performance analysis report.

Capgemini. (2023). World Retail Banking Report 2023.

Central Bank of, I. (2023). List of licensed banks and credit institutions.

Dalvand, V., Malek Akhlaq, A., & Dalvand, M. (2024). Analyzing the impact of social media on financial performance with the mediating role of social marketing in banks. Islamic Economics and Banking Quarterly, 50, 29-55. https://mieaoi.ir/browse.php?a_code=A-10-1500-1&sid=1&slc_lang=en

Dehghan, R. (2024a). Examining successful examples of digital transformation in Iran in banking. https://blog.podium.ir/examinig-successful-examples-of-digital-transformation-in-iran-in-the-fild-of-banking/

Dehghan, R. (2024b). What is open banking and its benefits for customers. https://blog.podium.ir/what-is-open-banking-and-what-are-the-benefits-for-Customers/

Deloitte. (2023a). 2023 banking and capital markets outlook. https://www.deloitte.com/us/en/insights/industry/financial-services/financial-services-industry-outlooks/banking-industry-outlook-2023.html

Deloitte. (2023b). Tech Trends 2023. https://www.deloitte.com/global/en/our-thinking/insights/topics/technology-management/content/tech-trends.html

Dia, E., & VanHoose, D. (2017). Banking in macroeconomic theory and policy. Journal of Macroeconomics. https://doi.org/10.1016/j.jmacro.2017.07.009

Ghadami, M., Mousakhani, M., Alvani, S. M., & Yazdani, H. R. (2022). Designing a digital banking policy model in Iran based on a network approach. Public Policy Quarterly, 8(1), 125-141. https://jppolicy.ut.ac.ir/article_85915.html?lang=en

Mohammadi Fateh, A., Poursadegh, N., & Mohammadi, D. (2019). Determinants of policymaking capacity in Iran's public sector. National Defense Strategic Management Studies, 3(12). https://issk.sndu.ac.ir/article_956.html?lang=en

Mohammadi, M., Norouzi, F., & Hosseini, N. (2023). The impact of social media and service quality on customer satisfaction in Bank Saderat Iran. https://civilica.com/doc/1644810

Monavarian, A., Divandari, A., Yaghoubi, S., & Spanloo, H. (2018). Describing and explaining the phenomenon of e-banking policymaking in Iran using grounded theory. Command and Control Quarterly, 2(3). https://ic4i-journal.ir/article-1-113-en.html

Osterwalder, A., & Pigneur, Y. (2023). Business Model Generation. AriaGhalam. https://books.google.nl/books/about/Business_Model_Generation.html?id=Bjj8G3ttLWUC&redir_esc=y

Rastegar, D. (2024). What is blockchain and how does it work? https://www.parspack.com/blog/blockchain-introduction

Schwab, K. (2016). The Fourth Industrial Revolution. Trade Printing and Publishing Co. https://law.unimelb.edu.au/__data/assets/pdf_file/0005/3385454/Schwab-The_Fourth_Industrial_Revolution_Klaus_S.pdf

Shaik, A. A., Glavee-Geo, R., & Karjaluoto, H. (2017). Exploring the nexus between financial sector reforms and digital banking culture. Research in International Business and Finance. https://doi.org/10.1016/j.ribaf.2017.07.039

Shargh, N. (2024). Over 50 banking apps in Iran. https://www.sharghdaily.com/%D8%A8%D8%AE%D8%B4-%D9%81%D9%86%D8%A7%D9%88%D8%B1%DB%8C-298/996228-%D8%A7%D9%BE%D9%84%DB%8C%DA%A9%DB%8C%D8%B4%D9%86-%D8%A8%D8%A7%D9%86%DA%A9%DB%8C-%D8%AF%D8%B1-%D8%A7%DB%8C%D8%B1%D8%A7%D9%86

Sheridan, N. (2024). HSBC marketing strategy 2025: A case study.

Skinner, C. (2021). Digital transformation in major world banks. Parchin Publications.

Westerman, G., McAfee, A., & Bonnet, D. (2019). Leading Digital. Nas. https://books.google.nl/books/about/Leading_Digital.html?id=Fh9eBAAAQBAJ&redir_esc=y

Yazdkhasti, H. (2024). What is a digital twin? About digital twins. https://www.hesam.pro/digital-twins

Zeng, D., Chen, H., Lusch, R., & Li, S. H. (2020). Social media analytics and intelligence. IEEE Intelligent Systems, 25(6). https://doi.org/10.1109/MIS.2010.151

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 Mina Oloumi Dodaran (Author); Davoud Zareian; Seyed Jamaledeen Tabibi, Ataolah Abtahi, Neda Soleimani (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.