Predicting Corporate Financial Distress Using a Hybrid Model of Artificial Immune System and Wavelet Neural Network (Artificial Intelligence)

Keywords:

Financial Distress, Financial Prediction, Wavelet Neural Network, Artificial Immune System, Logistic Regression, Hybrid AlgorithmAbstract

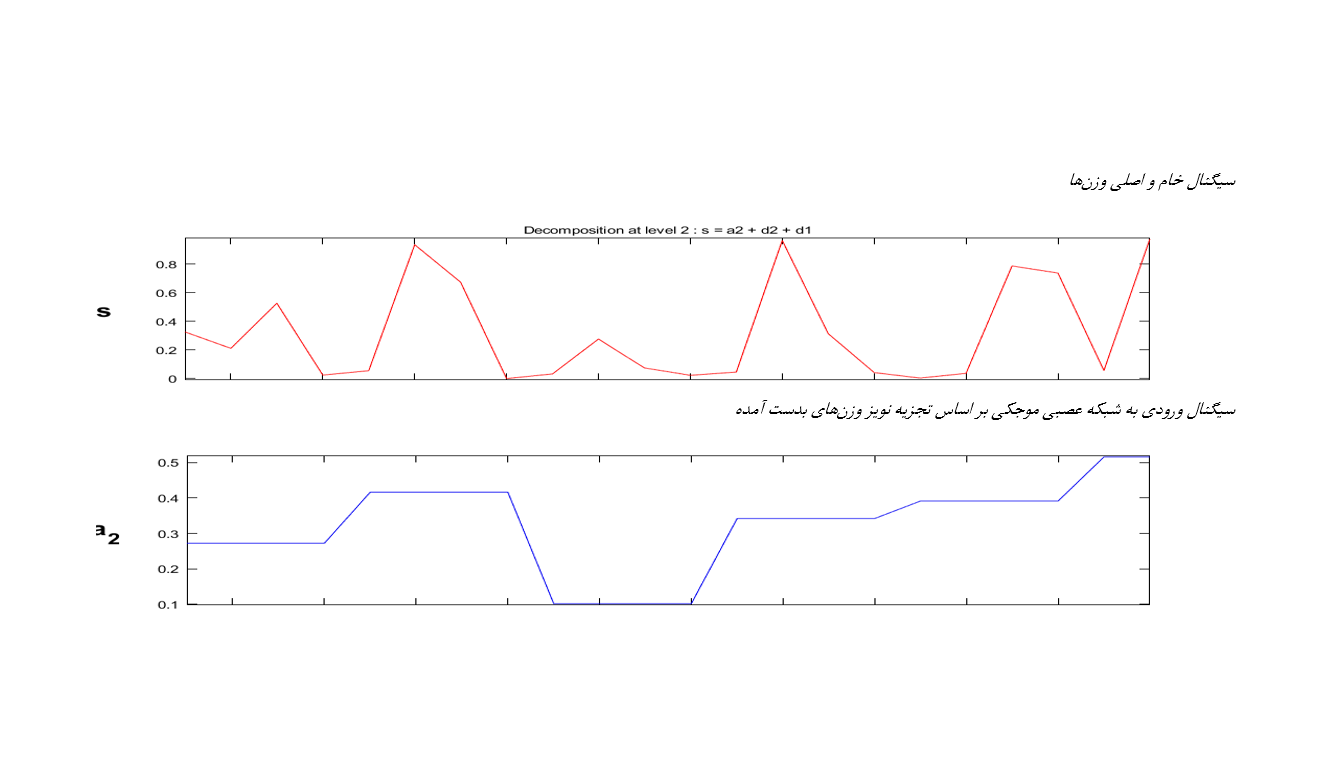

In today's financial landscape, the prediction of corporate financial distress plays a crucial role in risk management and economic stability. This study aims to develop a hybrid predictive model that combines the Artificial Immune System (AIS) with the Wavelet Neural Network (WNN) to forecast financial distress in companies. The hybrid model leverages the strengths of both algorithms to improve accuracy in identifying distressed firms based on financial data. Utilizing a dataset of Tehran Stock Exchange-listed companies, this research compares the performance of the hybrid model against traditional methods like logistic regression and standalone neural networks. Results demonstrate that the AIS-WNN hybrid model outperforms other techniques in terms of prediction accuracy, sensitivity, and overall robustness. The findings indicate that the proposed model provides a powerful tool for investors, auditors, and policymakers to anticipate financial distress and make informed decisions. This approach can be further expanded to other domains of financial forecasting, contributing to the advancement of predictive analytics in the field.

Downloads