Analysis of the Evaluation of Corporate Governance System Effectiveness in Iran Based on a Grounded Data Approach

Keywords:

Corporate Governance System, Effectiveness Evaluation, Grounded Data Approach, FintechAbstract

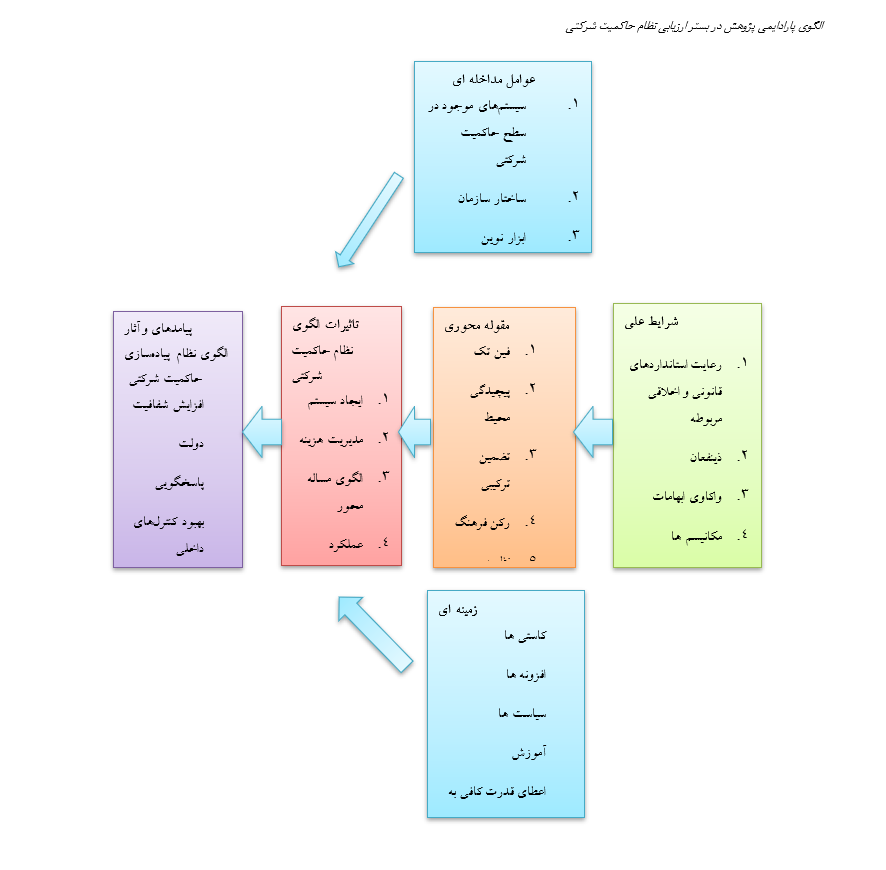

Corporate governance research is primarily focused on the inputs for effective governance; however, we have limited information about how corporate governance systems are continuously monitored and evaluated. The purpose of this article is to analyze the evaluation of corporate governance system effectiveness in Iran using a grounded data approach. The research population included 11 experts from academia familiar with corporate governance topics, selected using a snowball sampling method. Interviews were used to collect the necessary data. The research interviews were designed using the CAR framework and analyzed qualitatively using a grounded data approach. Data analysis was performed through open, axial, and selective coding, eventually leading to the presentation of a final model consisting of six main dimensions and thirty-two sub-dimensions. The results indicate that the model for evaluating the effectiveness of corporate governance in Iran revolves around the central category of fintech and monitoring, which are influenced by causal conditions. This process begins with causal conditions, leading to the formation of the central category, which, through strategic actions, contributes to increased transparency, accountability, improved internal controls, creativity, and resource optimization.

Downloads

References

Aguilera, R. V., Judge, W. Q., & Terjesen, S. A. (2018). Corporate governance deviance. Academy of Management Review, 43(1), 87-109. https://doi.org/10.5465/amr.2014.0394

Anderson, D. W., Melanson, S. J., & Maly, J. (2007). The evolution of corporate governance: Power redistribution brings boards to life. Corporate Governance: An International Review, 15(5), 780-797. https://doi.org/10.1111/j.1467-8683.2007.00608.x

Areneke, G., Adegbite, E., Tunyi, A., & Hussain, T. (2023). Female directorship and ethical corporate governance disclosure practices in highly patriarchal contexts. Journal of Business Research, 164. https://doi.org/10.1016/j.jbusres.2023.114028

Awais Amin, Q., & Cumming, D. J. (2023). Regulatory Reforms, board independence and earnings quality. Journal of International Financial Markets, Institution & Money, 88. https://doi.org/10.1016/j.intfin.2023.101840

Bai, C., Lu, J., & Tao, Z. (2006). The multitask theory of state enterprise reform: empirical evidence from China. The American economic review, 96, 353-357. https://doi.org/10.1257/000282806777212125

Bao, S. R., & Lewellyn, K. B. (2017). Ownership structure and earnings management in emerging markets-An institutionalized agency perspective. International Business Review, 26(5), 828-838. https://www.sciencedirect.com/science/article/abs/pii/S0969593117300999

Benton, R. A., & You, J. (2019). Governance monitors or market rebels? Heterogeneity in shareholder activism. Strategic Organization, 17(3), 281-310. https://doi.org/10.1177/1476127018776482

Chari, M. D., David, P., Duru, A., & Zhao, Y. (2019). Bowman's risk-return paradox: An agency theory perspective. Journal of Business Research, 95, 357-375. https://doi.org/10.1016/j.jbusres.2018.08.010

Chen, C. C.-h., Guo, R.-J., & Lin, L. Y.-H. (2023). The effect of political influence on corporate valuation: Evidence from party-building reform in China. International Review of Law and Economics, 73, 106120. https://doi.org/10.1016/j.irle.2022.106120

Clarke, D. (2016). Blowback: how China's efforts to bring private-sector standards into the public sector backfired. Is regulating the visible hand? In B. L. Liebman & C. J. Milhaupt (Eds.), The Institutional Implications of Chinese State Capitalism (pp. 29-47). Oxford University Press. https://doi.org/10.1093/acprof:oso/9780190250256.003.0002

Decaux, L., & Sarens, G. (2015). Implementing combined assurance: insights from multiple case studies. Managerial Auditing Journal, 30(1), 56-79. https://doi.org/10.1108/MAJ-08-2014-1074

Fenwick, M., McCahery, J. A., & Vermeulen, E. P. M. (2019). The End of "Corporate" Governance: Hello "Platform" Governance. European Business Organization Law Review, 20(1), 171-199. https://doi.org/10.1007/s40804-019-00137-z

Filatotchev, I., & Boyd, B. K. (2009). Taking stock of corporate governance research while looking to the future: Guest editorial. Corporate Governance: An International Review, 17(3), 257-265. https://doi.org/10.1111/j.1467-8683.2009.00748.x

Filatotchev, I., & Nakajima, C. (2014). Corporate governance, responsible managerial behavior, and corporate social responsibility: Organizational efficiency versus organizational legitimacy? Academy of Management Perspectives, 28(3), 289-306. https://doi.org/10.5465/amp.2014.0014

The Impact of Corporate Governance and Stakeholder Engagement on Organizational Resilience in Kuwaiti Islamic Financial Institutions. (2024). Rjfa. https://doi.org/10.7176/rjfa/15-3-05

Kovermann, J., & Velte, P. (2019). The impact of corporate governance on corporate tax avoidance-A literature review. Journal of International Accounting, Auditing and Taxation, 36, 100270. https://www.sciencedirect.com/science/article/pii/S1061951818301071

Lumineau, F., Wang, W., & Schilke, O. (2021). Blockchain Governance - A New Way of Organizing Collaborations? Organization Science, 32(2), 500-521. https://doi.org/10.1287/orsc.2020.1379

Mahmudi, B. (2024). Corporate Governance Mechanisms and Financial Performance: A Systematic Literature Review in Emerging Markets. Productivity, 1(3), 270-285. https://doi.org/10.62207/gqtv4c76

Ni Luh Putu Agustin Nirmala, S. (2024). Does Good Corporate Governance and Political Connection Have an Influence a Tax Avoidance? Formosa Journal of Multidisciplinary Research, 3(3), 253-262. https://doi.org/10.55927/fjmr.v3i3.8584

Oktaviani, R. M. (2023). The Impact of Corporate Governance and Fiscal Loss Compensation on Tax Avoidance Policies: Indonesian Banking Sector. International Journal of Sustainable Development and Planning, 18(11), 3641-3647. https://doi.org/10.18280/ijsdp.181130

Samans, R., & Nelson, J. (2022). Corporate Governance and Oversight. In Sustainable Enterprise Value Creation. Palgrave Macmillan. https://doi.org/10.1007/978-3-030-93560-3

Sands, A. (2019). Bots in the Boardroom: The Promise of AI.

Siddiqui, F., YuSheng, K., & Tajeddini, K. (2023). The role of corporate governance and reputation in the disclosure of corporate social responsibility and firm performance. Heliyon, 9(5). https://doi.org/10.1016/j.heliyon.2023.e16055

Thoan, L. T. (2024). Corporate Governance in Listed Firms: Does Market Competition Make a Difference? Asian Academy of Management Journal, 29(1), 171-203. https://doi.org/10.21315/aamj2024.29.1.7

Till, R. E., & Yount, M. B. (2019). Governance and Incentives: Is It Really All about the Money? Journal of Business Ethics, 159(3), 605-618. https://doi.org/10.1007/s10551-018-3778-5

Wau, M. (2023). Financial Risk, Corporate Governance, and Financial Performance: An Empirical Study on Bank Indonesia. Jurnal Akuntansi Keuangan Dan Bisnis, 16(2), 179-188. https://doi.org/10.35143/jakb.v16i2.6139

Wu, Z., Lin, S., Chen, T., Luo, C., & Xu, H. (2023). Does Effective Corporate Governance Mitigate the Negative Effect of ESG Controversies on Firm Value? Economic Analysis and Policy. https://www.sciencedirect.com/science/article/pii/S0313592623002990

Zhu, J. J., Caleb, H. T., & Li, X. (2019). Unfolding China's state-owned corporate empires and mitigating agency hazards: Effects of foreign investments and innovativeness. Journal of World Business, 54(3), 191-212. https://www.sciencedirect.com/science/article/pii/S1090951617306715

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 Zohreh Fahimnejad, Massoud Gholamzade Ledari, Hashem Nikomaram, Ghodratollah Talebnia (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.