Presenting a Novel Approach Model in the Strategic Management of Organizations with Emphasis on Environmental Accounting Based on Social Responsibility Indicators and Audit Quality

Keywords:

Strategic management, environmental accounting, social responsibility, audit qualityAbstract

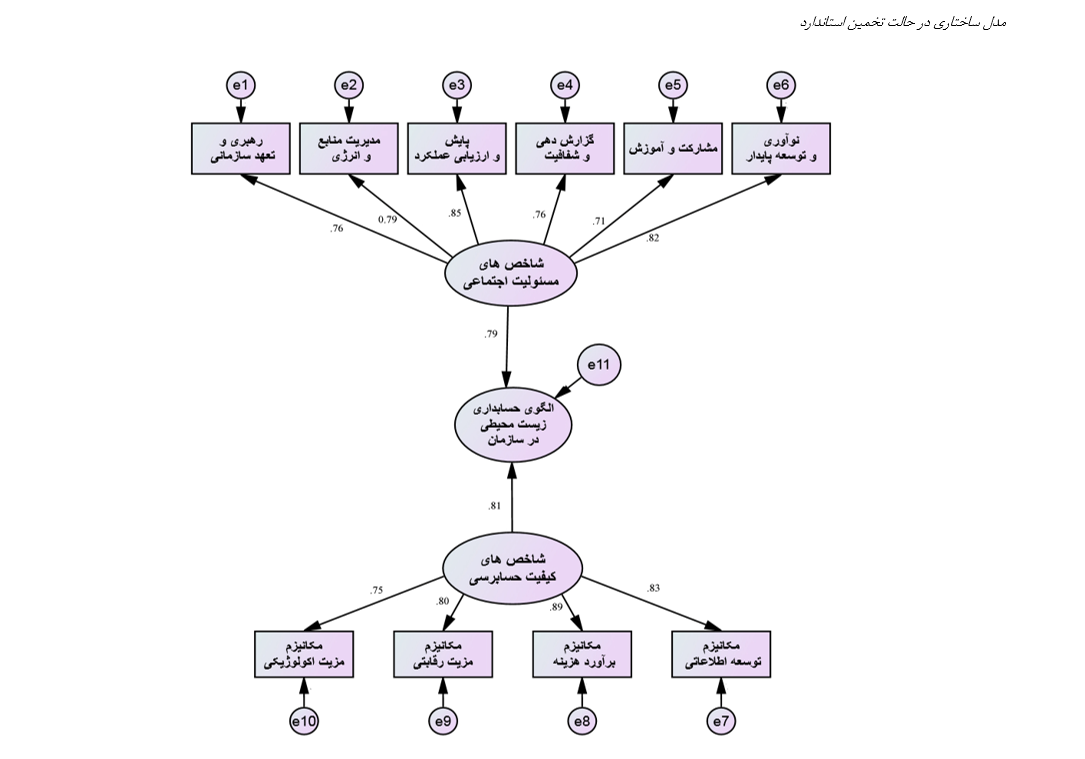

Environmental accounting, as a tool for recording and reporting an organization's environmental activities, contributes to increased transparency and accountability while guiding organizations toward sustainability. This research aims to examine the relationship between environmental accounting, social responsibility, and audit quality, seeking to provide a model that can assist organizations in improving transparency, sustainability, and commitment to social responsibilities. The research method employed in this study was a mixed qualitative-quantitative approach. In the qualitative section, the population consisted of experts familiar with the research topic (university professors in the studied field), and sampling in this part was conducted theoretically. In the quantitative section, the population included financial managers of Tehran Stock Exchange and Securities Company, with 119 individuals selected using accessible sampling as the statistical sample. The data analysis methods in the qualitative section were based on open and axial coding, while the quantitative section utilized KMO and Bartlett's tests, one-sample t-tests in SPSS software, and structural equations in AMOS software. The results of this study indicate that environmental accounting can play a significant role in enhancing the social accountability of organizations and improving audit quality. Overall, it can be stated that this practical model can serve as a strategic tool in enhancing the environmental and social performance of organizations, and its positive outcomes can lead to the strengthening and sustainability of organizational relationships and the improvement of audit quality.

Downloads

References

Abed, I. A., Hussin, N., Haddad, H., Al-Ramahi, N. M., & Ali, M. A. (2022). The moderating effects of corporate social responsibility on the relationship between creative accounting determinants and financial reporting quality. Sustainability, 14(3), 1195. https://doi.org/10.3390/su14031195

Agnes, K. (2023). The effect of green accounting, company size, profitability, media disclosure, and board of commissioners' size on corporate social responsibility disclosure. International Journal Papier Public Review, 4(2), 1-17. https://doi.org/10.47667/ijppr.v4i2.203

Ahmed, Z., Asghar, M. M., Malik, M. N., & Nawaz, K. (2020). Moving towards a sustainable environment: the dynamic linkage between natural resources, human capital, urbanization, economic growth, and ecological footprint in China. Resources Policy, 67, 101677. https://doi.org/10.1016/j.resourpol.2020.101677

Akbar, N. B. A., & Mahdi, F. S. (2023). The Interest of the Supreme Audit Institution in Sustainable Economic, Social and Environmental Development on the Audit Quality Performance. International Journal of Professional Business Review, 8(1), 21. https://doi.org/10.26668/businessreview/2023.v8i1.1164

Al-Shaer, H. (2020). Sustainability reporting quality and post-audit financial reporting quality: Empirical evidence from the UK. Business Strategy and the Environment, 29(6), 2355-2373. https://doi.org/10.1002/bse.2507

Al Shanti, A. M., & Elessa, M. S. (2023). The impact of digital transformation towards blockchain technology application in banks to improve accounting information quality and corporate governance effectiveness. Cogent Economics & Finance, 11(1), 2161773. https://doi.org/10.1080/23322039.2022.2161773

Alassuli, A. (2024). The role of environmental accounting in enhancing corporate social responsibility of industrial companies listed on the Amman Stock Exchange. Uncertain Supply Chain Management, 12(1), 125-132. https://doi.org/10.5267/j.uscm.2023.10.012

Ali, I., Rehman, K., Ali, S., Yousaf, J., & Zia, M. (2010). Corporate social responsibility influences, employee commitment and organizational performance. African journal of business management, 4(12), 2796-2801. https://nachhaltig-sein.info/wp-content/uploads/2012/12/Ali-et-al_CSR-Influences-employee-commitment-and-organizational-performance.pdf

Angotti, M., Ferreira, A. C. D. S., Eugénio, T., & Branco, M. C. (2024). A narrative approach for reporting social and environmental accounting impacts in the mining sector-giving marginalized communities a voice. Meditari Accountancy Research, 32(1), 42-63. https://doi.org/10.1108/MEDAR-11-2021-1513

Appannan, J. S., Mohd Said, R., Ong, T. S., & Senik, R. (2023). Promoting sustainable development through strategies, environmental management accounting and environmental performance. Business Strategy and the Environment, 32(4), 1914-1930. https://doi.org/10.1002/bse.3227

Appiagyei, K., & Donkor, A. (2024). Integrated reporting quality and sustainability performance: does firms' environmental sensitivity matter? Journal of Accounting in Emerging Economies, 14(1), 25-47. https://doi.org/10.1108/JAEE-02-2022-0058

Arif, M., Sajjad, A., Farooq, S., Abrar, M., & Joyo, A. S. (2021). The impact of audit committee attributes on the quality and quantity of environmental, social and governance (ESG) disclosures. Corporate Governance: The International Journal of Business in Society, 21(3), 497-514. https://doi.org/10.1108/CG-06-2020-0243

Asante-Appiah, B. (2020). Does the severity of a client's negative environmental, social and governance reputation affect audit effort and audit quality? Journal of Accounting and Public Policy, 39(3), 106713. https://doi.org/10.1016/j.jaccpubpol.2019.106713

Aziz, A., Salman, S. M., Hassan, M., Younus, M. K., & Uddin, H. F. (2023). The Impact of Audit Firm Size, Auditor Independence and Financial Expertise on Earning Quality: Mediating Role of Audit Quality. Irasd Journal of Economics, 5(4), 1075-1086. https://doi.org/10.52131/joe.2023.0504.0180

Shi, H., Liu, H., & Wu, Y. (2024). Are socially responsible firms responsible to accounting? A meta-analysis of the relationship between corporate social responsibility and earnings management. Journal of Financial Reporting and Accounting, 22(3), 311-332. https://doi.org/10.1108/JFRA-06-2021-0171

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 Mona Hashempour Abandansari (Author); Mohammad Mehdi Abbasian Fredoni; Abbas Ali Pour Aghajan, Aliakbar Ramezani, Alireza Modanlo Joibary (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.